Tax Relief Act 2024 Update Form – it’s necessary to complete Form 656-B. If dealing with the complexities of this 32-page document becomes overwhelming or causes undue stress, hiring a reputable tax relief company may prove . The U.S. Congress is expected to act as early as this month on a legislation to make more families in the nation—including in the Marianas—eligible for the maximum child tax .

Tax Relief Act 2024 Update Form

Source : itep.org

Tax Pro Center | Intuit | Tax Pro Center

Source : accountants.intuit.com

Business Tax Renewal Instructions | Los Angeles Office of Finance

Source : finance.lacity.gov

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Bette Hochberger, CPA, CGMA

Source : www.facebook.com

Tax and payroll reminders for the 2024 new year | UCnet

Source : ucnet.universityofcalifornia.edu

News Flash • Maximize Savings on Taxes with a FNSB Property

Source : www.fnsb.gov

Boyer Financial Planning | Somerset PA

Source : www.facebook.com

W 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

LEVERAGE SALT VOL. 7 fix sales tax exemption certificate

Source : www.linkedin.com

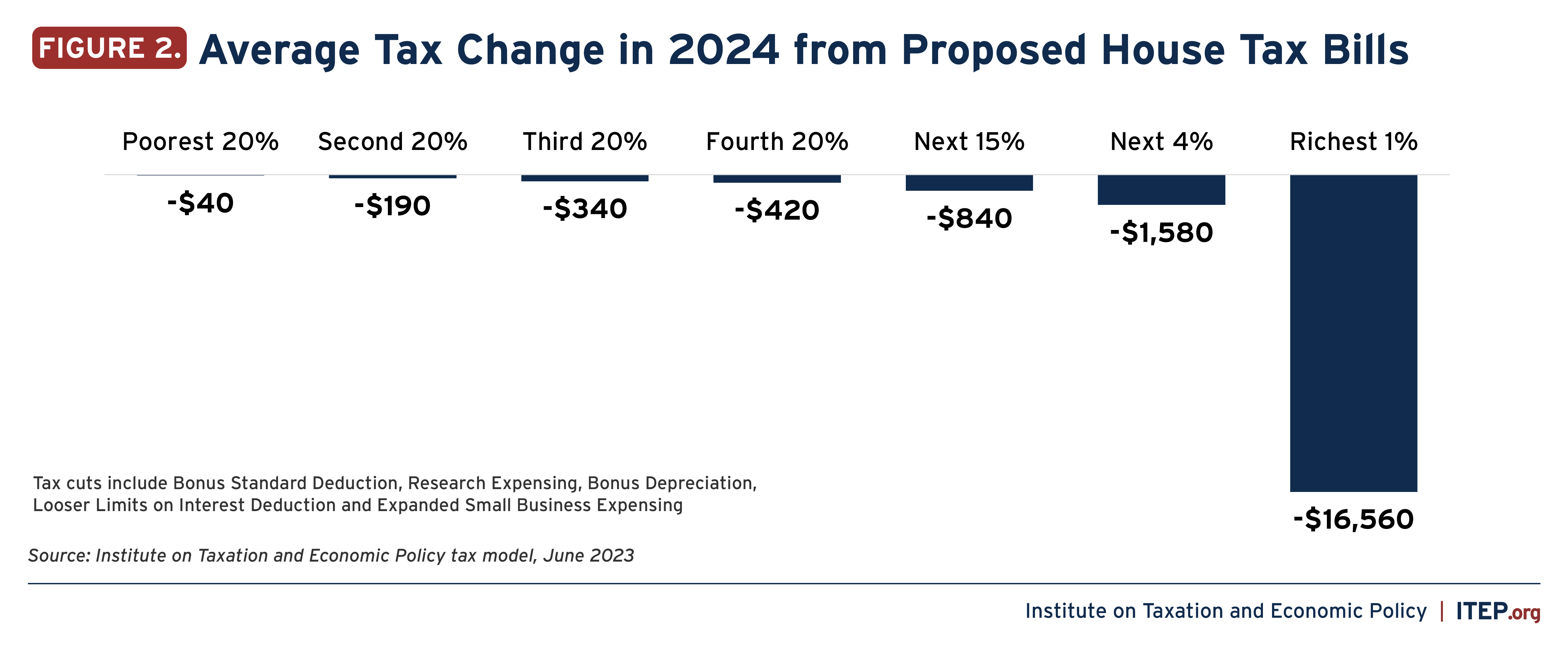

Tax Relief Act 2024 Update Form Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While : The Income Tax Department has notified ITR forms 1 and 4, which are filed by individuals and entities with annual total income of up to ₹50 lakh, for assessment year (AY) 2024-25. The I-T . Commissions do not affect our editors’ opinions or evaluations. Tax relief companies say they can work with the IRS and state tax agencies to reduce or eliminate your tax debt. But the Federal .