Tax Relief Act 2024 Summary – one path to diminish their tax obligation is taking part in tax relief initiatives. Administered by the federal government and certain state entities, these programs offer various advantages . Senate Finance Committee Chair Ron Wyden and House Ways and Means Committee Chair Jason Smith have jointly announced a bipartisan tax framework that promotes the financial security of working families .

Tax Relief Act 2024 Summary

Source : www.catf.us

Summary of Tax Incentives in the Inflation Reduction Act of 2022

Source : www.catf.us

The Bluebook: A Summary of Key Tax Topics for 2024 | FORVIS

Source : www.forvis.com

Legislation & Legislation Proposals Archives — NCSHA

Source : www.ncsha.org

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

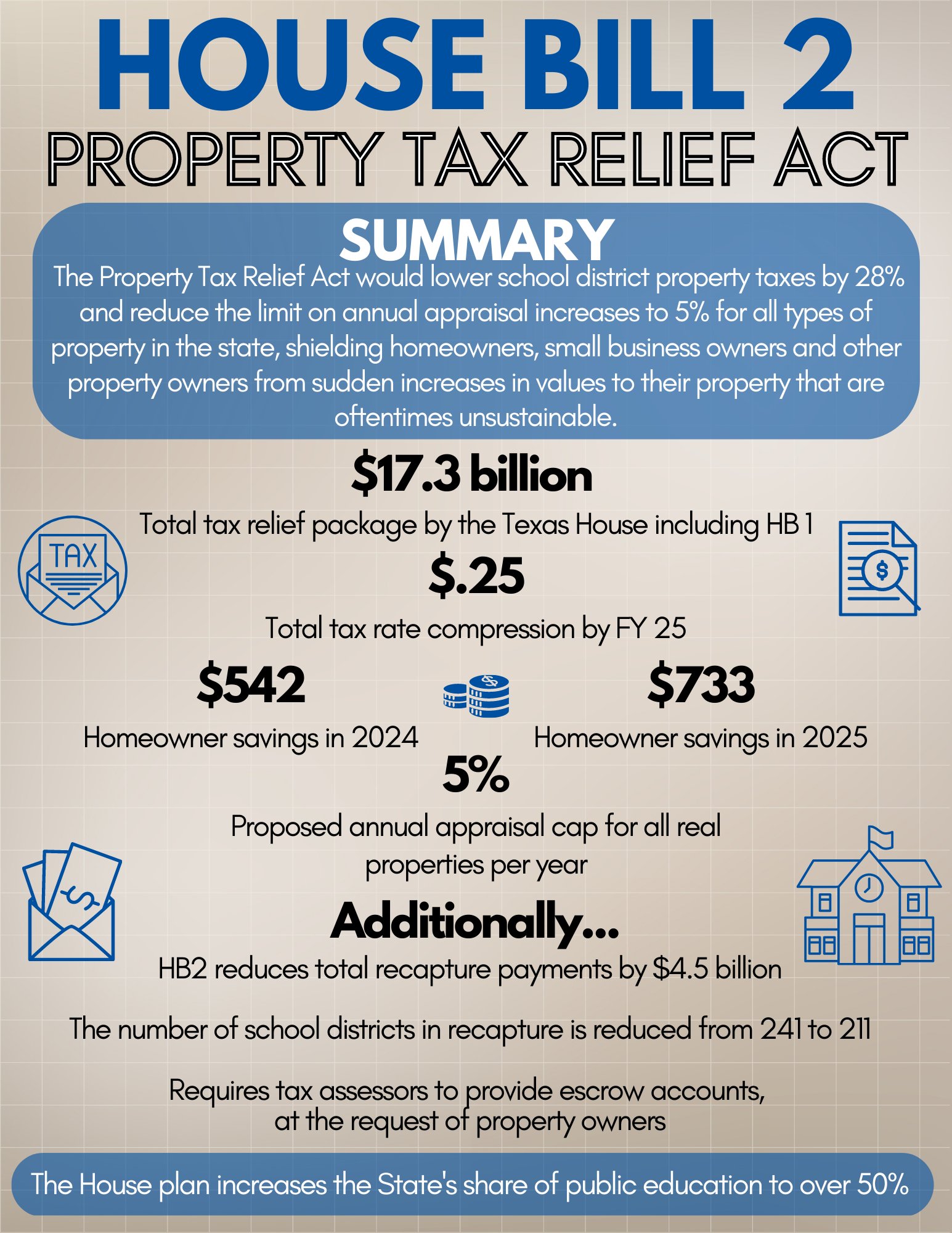

Texas House Republican Caucus on X: “????FLOOR UPDATE???? The House

Source : twitter.com

Bipartisan Tax Framework: Low Income, Wealthy Households Benefit

Source : www.taxpolicycenter.org

J.K. Lasser’s Small Business Taxes 2024: Author’s Overview

Source : bigideasforsmallbusiness.com

Countdown for Gift and Estate Tax Exemptions | Charles Schwab

Source : www.schwab.com

ITC IRA 2022 Heat is Power

Source : www.heatispower.org

Tax Relief Act 2024 Summary Summary of Tax Incentives in the Inflation Reduction Act of 2022 : In October, Gov. Maura Healey signed a $1 billion tax relief package designed to benefit renters, caregivers, and seniors. The law went into effect when it was signed, but with residents poised to . Commissions do not affect our editors’ opinions or evaluations. Tax relief companies say they can work with the IRS and state tax agencies to reduce or eliminate your tax debt. But the Federal .