Child Tax Credit 2024 Qualifications Table – For the 2024 tax year, the child tax credit remains at up to $2,000, but the refundable portion of the credit increases to $1,700. This means eligible taxpayers could receive an additional $100 . Gypsy Rose, from convincing boyfriend to kill her mother to becoming a TikTok star The Child credit can be claimed on the federal tax return (Form 1040 or 1040-SR) and must be filed by April .

Child Tax Credit 2024 Qualifications Table

Source : pluginamerica.org

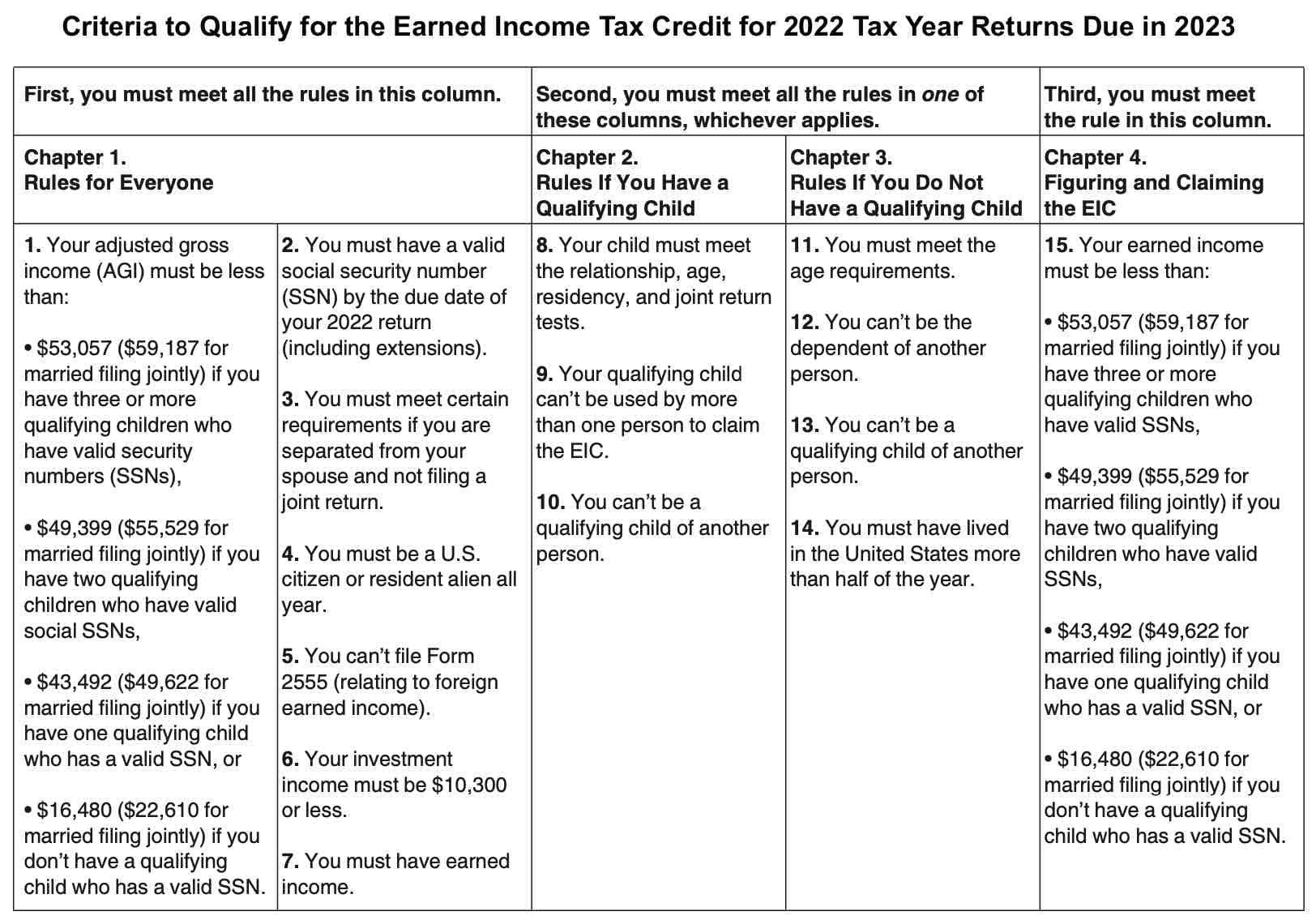

Earned Income Tax Credit, EITC; Tax Credit Amounts, Limits

Source : www.efile.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Yearly Income Guidelines and Thresholds Beyond the Basics

Source : www.healthreformbeyondthebasics.org

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Child Tax Credit: Income Limits for Eligibility Increased The Hype

Source : www.thehypemagazine.com

The American Families Plan: Too many tax credits for children

Source : www.brookings.edu

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Child Tax Credit 2024 Qualifications Table 2024 Federal EV Tax Credit Information & FAQs Plug In America: The child tax credit and other family tax credits and deductions can have a significant impact on your tax liability and potential refund. However, the qualifications for the 2024 tax year . Tax season is here. With all the forms and applications you need to fill out, it’s easy to get confused. But USA TODAY has got you covered with a series of stories and tips that will hopefully .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)